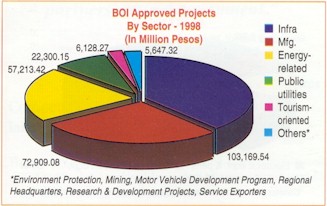

Investment Opportunities

The Philippines offers a wide choice of opportunities into which prospective investors can channel funds and technology.

1999 Investment Priorities Plan (IPP)

The IPP identifies priority economic areas entitled to incentives under the Omnibus Investments Code of 1987. The 1999 IPP includes preferred sectors being promoted to direct capital flows to the best locations in the countryside.

Among these:

- export-oriented industries

- support industries (e.g. autoparts, electronic components, R&D, education and training and health/medical services)

- computer software

- infrastructure

- tourism

- mining

Investors may also buy into established Filipino firms to access an expanding market.

Agriculture Modernization Program

The Medium-Term Philippine Development Plan for 1999-2004 stresses agricultural modernization as the 'linchpin' in the country's overall development initiatives. Consistent with this thrust, the 1999 IPP lists major agriculture and fishery projects and services which offer opportunities to enterprising investors.

Among these areas: large-scale plantations or nucleus estates with warehousing and processing facilities, swine or cattle-breeding, feeds and feedmill projects and post-harvest facilities.

Market-driven, competitive agri-industries are seen as a way to broaden the country's export base.

Gateway to 500 million ASEAN Market

The Philippines lies at the heart of two great commercial sea lanes- the Pacific Ocean and South China Sea- the crossroads of eastern and western business, trade and culture.

A strategic entry point and manufacturing platform to the 500-million strong ASEAN consumer market that is expected to post double digit growth in the coming years.

A market where average incomes are predicted to rise to $5,000 in a decade, from today's $1,000.

'Bold' measures initiated at the Hanoi summit within the Framework Agreement on the ASEAN Investment Area (AIA) make it easy for non-ASEAN investors to access this huge market. Under the "two-year window" (01 January 1999 to 31 December 2000), non-ASEAN nationals applying to invest in manufacturing and service ventures will get the same treatment as ASEAN citizens.

| Incentives to Manufacturing Investors | |

|

Economic Zones and Industrial Estates

Numerous Special Economic Zones equipped with excellent infrastructure and communication facilities are ready for use by new industrial locators.

The Philippine Export Zone Authority (PEZA) manages 56 such zones while 50 others are in various stages of development.

Leading these zones are Subic Bay Metropolitan Authority (SBMA) and the Clark Development Corporation. Two more free ports are being developed- Cagayan Economic Zone and Free Port in northern Luzon and the Zamboanga Economic Zone in southern Mindanao.

Foreign Investments Act of 1991

The Foreign Investments Act of 1991 (R.A. #7042 as amended by R.A. 8179) liberalized the entry of foreign investments into the Philippines.

Its passage by Congress marked the end of decades of protectionism for local businesses.

Restrictions were relaxed on the participation of foreigners as equity shareholders in local firms, using the Foreign Investment Negative List (FINL) as a guide to levels of foreign equity allowed in specific activity areas. This has made the rules for entry of foreign investments into the Philippines clear and less cumbersome.

| FIA -Selected Features | |

|

Competitive Investment Package

The Philippines has one of the most liberal policy and regulatory frameworks for investments in Southeast Asia.

The Philippines Constitution guarantees basic rights to all investors and enterprises.

There are six major investment-related laws:

- The Omnibus Investments Code of 1987 (Executive Order #226)

- The Foreign Investments Act of 1991 (R.A. #7042)

- The Special Economic Zone Act of 1995 (R.A. #7042)

- The Bases Conversion and Development Act of 1992 (R.A. #7117)

- The Export Development Act of 1994 (R.A. #7844)

- The Built-Operate-Transfer (BOT) Law (R.A. #6957)

The Built-Operate-Transfer (BOT) Law (R.A. #6957 as amended by R.A. #7718) spells out the policy and regulatory framework for private sector participation in infrastructure projects and other public services. A model of public-private sector partnership in Asia, it has brought in private capital of $21 billion in power plants, mass transit systems, and expressways, among others.

Social laws also provide incentives to certain industries such as mining, iron and steel, and book publishing.

Attractive investment incentive packages are offered under those different laws for qualified foreign and local investors.

Measures continue to be taken to ease investor entry and further enhance the business operating environment.